Tax Facts

We offer a full range of free, easy to use, online resources including:

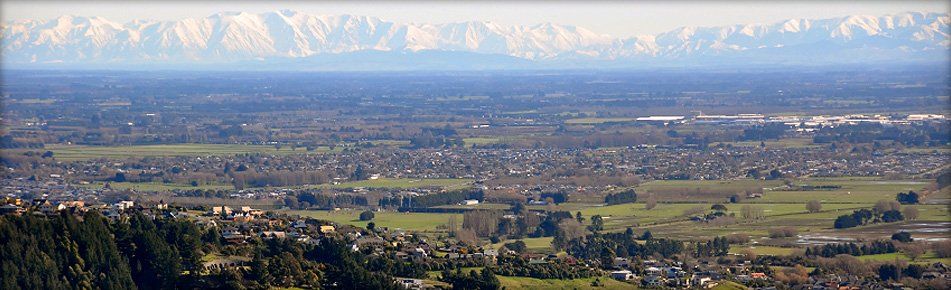

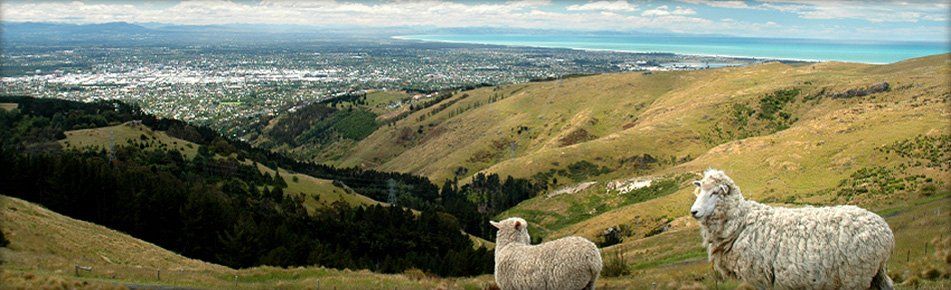

Unit 4 27 Sir William Pickering Drive, Burnside, Christchurch 8053

Ph:

03-366 6955

Email: enquiry@qca.co.nz

Copyright Quantum Chartered Accountants ©

| Disclaimer

| Site Map

| Websites for accountants by Wolters Kluwer